Our History

The birth of Regulatory Incubation the Wholesale Appointed Representative Firm:

Sturgeon Ventures was the trading name of Seonaid Mackenzie sole trader from 1999-2006 when Sturgeon Ventures was incorporated into Sturgeon Ventures LLP.

When first authorised by the SFA the Securities & Financial Authority there were no Approved Persons, this was introduced in 2000 and the first person Incubated in financial services was Iain Rugheimmer in December 2001 when the term Regulatory Incubator was coined by Seonaid.

A couple of people joined from ABN AMRO’s corporate team 29 September 2003 lead by Henry Tillman to use the Incubator to launch their own business, to specialise in insurance corporate finance. Insurance companies in Retail traditionally sold their products to Retail via an Appointed Representative Firm, so Seonaid contacted the FCA to see if the Appointed Representative route could be used for corporate finance and it was allowed so Grisons Peak LLP became an Appointed Representative Firm in 21st July 2006.

Haibun was a spin out of a larger firm as a Wholesale Appointed Representativein 2005 on the 22nd September.

Wealth management:

Sturgeon and its Appointed Representative Firms, continue to be advisors to Single Family Offices (SFOs) and Multi-Family Offices (MFOs).

Corporate Finance:

Sturgeon and its’ Appointed Representative Firms have advised on fund raisings both private and public and also on acquisitions in the last ten years.

Investor Relations & Due Diligence Services:

Sturgeon Compliance Services, also offers due diligence and investor relation services.

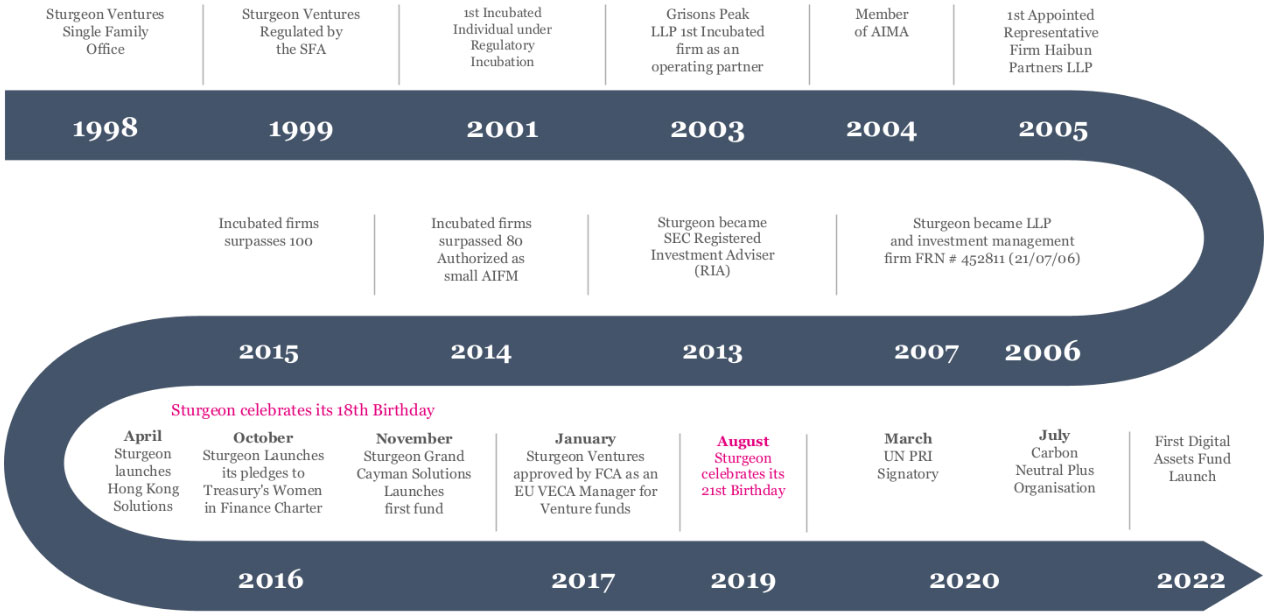

History of Sturgeon Ventures – Timeline: