Consequences of Brexit on UK AIFMs marketing in the EU

The consequences of the UK leaving the EU need to be considered, in particular the impact on full-scope UK AIFMs that became non-EEA AIFMs on Brexit.

The UK withdrew from the EU and the EEA on 31 January 2020. Following its withdrawal, the UK entered a transition period until 31 December 2020, during which EU law continued to apply in the UK. On 24 December 2020 the UK and the EU announced they had agreed a UK-EU Trade and Cooperation Agreement (the TCA) to apply in principle from 1 January 2021, prior to being ratified in the UK and EU Parliaments. The financial services provisions of the TCA are very limited: there are no equivalence decisions and, as anticipated, neither does the TCA include any rights for UK firms to passport their services into the EU from 1 January 2021. Whilst the TCA contained a commitment to have discussions on financial services cooperation, it is unrealistic to think that this will lead to any significant changes to the current position.

The UK is now a third country for the purposes of AIFMD. UK AIFMs are ‘third country firms’ who are unable to use the AIFMD marketing passport.

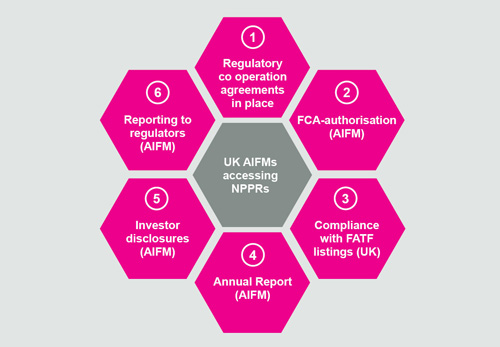

Pending (and subject to) the extension of the third country passport to the UK, UK AIFMs marketing AIFs in the EU can only access investors in each of the EU27 member states pursuant to the Article 42 National Private Placement Regimes (NPPRs). There are three principal pre-conditions for UK AIFMs being able to register for marketing into EU27 member states under the Article 42 NPPRs. First, that regulatory co-operation agreements are in place, to cover supervisory co-operation, information exchange and enforcement. A multilateral Memoradum of Understanding (MoU) between the FCA, ESMA and the EEA regulatory authorities was agreed in February 2019 and came into effect on 1 January 2021. In addition to the MoUs for the relevant member state being in place, the UK AIFM will have to be FCA-authorised and meet the relevant AIFMD compliance requirements (as summarised below). Thirdly, the fact that the third country (ie the UK) is not listed as a non-cooperative territory and country by the Financial Action Task Force. It should be noted that national competent authorities (NCAs) may revoke or suspend the ability of an AIFM to market into its jurisdiction under the NPPR in certain circumstances, for example where it considers the marketing to be undesirable in the interests of the investors or potential investors.

The AIFMD compliance requirements referred to above are that the AIFM:

(i) discloses information to investors in advance of their subscription;

(ii) prepares and provides an annual report to

investors; and

(iii) reports to the NCA(s) as relevant.

In relation to the provision of initial information, it is not necessary for this to be included in the offering document (although this may be preferable from a best practice perspective).

In practice, NCAs often request a stand-alone schedule of an AIFM’s Article 23 disclosures for the AIF being marketed, which can also be appended to the offering document.

In addition to the threshold conditions that AIFMD imposes on AIFMs who have to rely on NPPRs to access investors in the EU27, individual member states can (and some have) imposed additional requirements on AIFMs and in certain jurisdictions an NPPR has not been made available. Marketing using NPPRs is therefore piecemeal, and can be time-consuming and costly, whereby managers need to apply on a country-by-country basis for permission to market individual funds. Unlike the AIFMD marketing passport, the NPPR notification process is not managed by the home state regulator.

In some cases UK AIFMs may be able to continue servicing EEA clients on a temporary and limited basis using reciprocal access arrangements where these were in place between the UK and EU27 prior to exit day.

Contact

For Further Information please contact our team on:

E hello@sturgeonventures.com

T +44 203 167 4625

W www.sturgeonventures.com

Bryan Cave Leighton Paisner contact

Matthew Baker

E: matthew.baker@bclplaw.com

T: +44 (0) 20 3400 4902

W: https://www.bclplaw.com

For Information Purposes Only: This update was prepared by Bryan Cave Leighton Paisner and is distributed by Sturgeon Ventures. It is for general informational purposes only. The information contained herein does not constitute or offer legal or other advice and you should not rely on it as such advice. Although all reasonable skill and care has been taken in compiling this financial promotion, no warranty is given as to its accuracy or completeness. The opinions expressed accurately reflect the views at the date of this update and, whilst the opinions stated are

honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice.

Sturgeon Ventures LLP (FRN 452811) is Authorised and Regulated by the UK Financial Conduct Authority (FCA) www.fca.gov.uk

March 2021